A couple of days back, DoorDash publicly filed its S1 filings. I spent a few hours reading through the S1 filing and have summarized some of my learnings here. Enjoy!

Introduction

What's the first thing that comes to your mind when you think of DoorDash? Food Delivery? Restaurants? Food?

Well, DoorDash is all of that... plus a lot more. This company at its essence, is a three sided logistics platform that connects local businesses (merchants) to consumers through dashers (independent contractors who deliver goods from businesses to consumers) to grow and empower local economies.

Consumers use DoorDash for the convenience, wide selection of restaurants.

Independent contracts (dashers) look at DoorDash as a source of earnings.

Merchants use DoorDash for:

Demand creation: Through the (i) consumer and (ii) DoorDash for work app, DoorDash unlocks access to existing and new customers.

Logistic Services: Access to dashers to fulfill demand generated through the DoorDash apps as well as through the merchant's own website (white label service).

Total Addressable Market

(in the US)

I found this data pretty interesting - in 2019, out of $601B spent on restaurants, bars, and cafes, almost 50% was spent on food that was consumed off premise! In other words, DoorDash’s current market size is ~$303B of which it has captured $8B (3%).

This market size analysis is based on DoorDash's current market. In the very near future, they plan on expanding into other verticals such as groceries, florists, pharmacies etc.

Note: Gross Order Value is not the same as revenue. Gross Order Value is the dollar value of orders completed on DoorDash, including taxes, tips, and any applicable consumer fees. We will take about revenue later on in this post.

Go To Market Strategy

One of the things that really stood out to me, when I read DoorDash's S1 filings, was the go-to-market strategy.

While most of the food delivery platforms were focused on winning in the highly dense metropolitan areas, DoorDash was contrarian and instead focused on suburban markets and smaller metropolitan areas. This was a key reason for DoorDash to race ahead in the food delivery market. Here's why:

Suburban markets have had a higher growth rate for on demand food delivery services.

On demand food delivery is supremely useful in suburban markets due to increased distance to restaurants and lack of alternatives.

Large average order value - customers tend to be families.

To provide a wide selection to consumers in suburban areas, DoorDash partnered with 175 of the top 200 largest national restaurants.

Business Model

DoorDash generates revenue through:

Marketplace commission and fees

DashPass

DoorDash Drive

Merchant Services

Marketplace Commissions and Fees

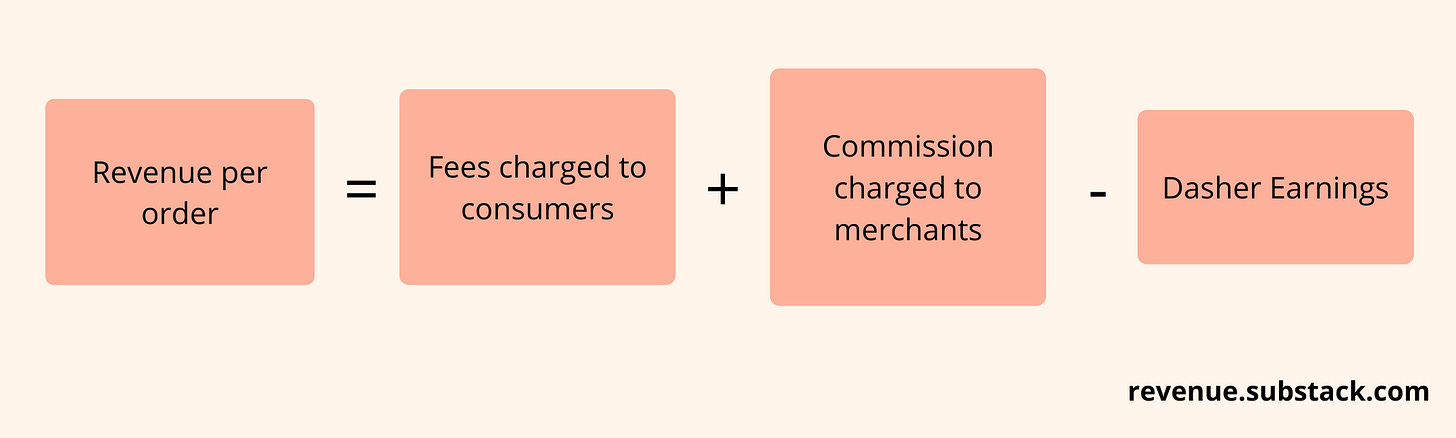

DoorDash generates a majority of its revenue from fees paid by consumers and commission charged to merchants for orders completed on its platform.

DoorDash enters into agreements with merchants where they agree on the commission fee for orders generated and fulfilled on DoorDash's marketplace.

From the consumer side, for each order, DoorDash charges a fixed delivery fee and a variable service fee based on the order value.

After paying out earnings to dashers from the fees charged to consumers and commission charged to merchants, DoorDash recognizes the remaining amount as its revenue.

For the curious minds out there, Dasher earnings is based on (i) a base pay amount for each order, which depends on the estimated time, distance, and desirability of the order, (ii) promotions for orders that meet certain conditions, including bonuses for Dashers who meet specific goals, and (iii) tips from consumers

DashPass

DashPass is the subscription product that costs $9.99/month. With DashPass, consumers pay $0 for delivery fee and a lowered variable service fee.

DoorDash has ~5M DashPass members.

DoorDash Drive

Drive is the white label logistics service that enables merchants to fulfill orders placed on their own website. DoorDash charges a per-order fee as part of its Drive product.

Merchant Services

DoorDash provides marketing solutions that allows merchants to create promotions on its marketplace. Revenue is generated via a per-order marketing fee from merchants.

Market Position

With a highly differentiated go to market strategy and a large restaurant selection, DoorDash has been dominating the market. Here are a few stats:

Market Share

Total Orders

(in Millions)

Prior to COVID, orders were increasing at a pretty predictable pace of 15-25% quarter over quarter. In Q2 2020 however, orders placed shot up by 100% when compared to the previous quarter (103M → 204M). My guess is as good as yours... this is most likely due to COVID.

Gross Order Value

(in Millions)

Marketplace GOV is the total dollar value of orders completed on DoorDash, including taxes, tips, and any applicable consumer fees, including membership fees related to DashPass.

The growth rate of Gross Order Value pretty much mimics that of the # of total orders... which is once again not surprising → these two metrics are interconnected. Similar to what we saw in the graph related to # of Total Orders, Gross Order Value saw a massive jump in Q2 2020 due to COVID.

# of Customers, Merchants and Dashers

As of September 2020, DoorDash had:

Consumers: 18 million consumers. When you view the consumers through a cohort lens, where a cohort is defined as the group of consumers that joined in a specific year, gross order value generated from each cohort has grown with time. This indicates that consumers on DoorDash retain and get increased value over time. For ex, the cohort of users that joined in 2016 spent 57% more in 2019 than they did in 2016.

Merchants: 390,000 Merchants including 175 of the 200 largest national restaurant brands

Dashers. 1+ million Dashers. Dashers have earned a total of $7B from the DoorDash platform

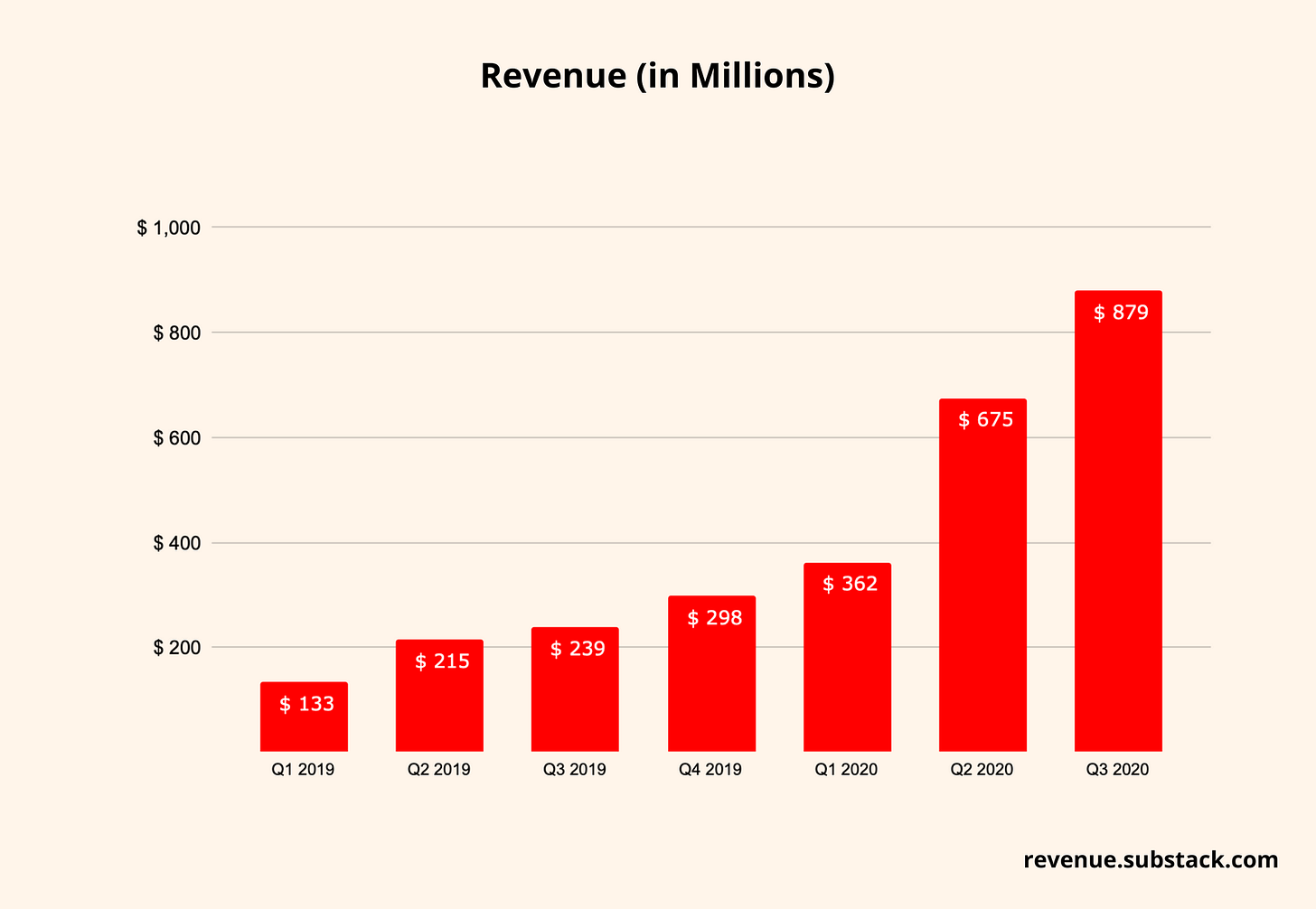

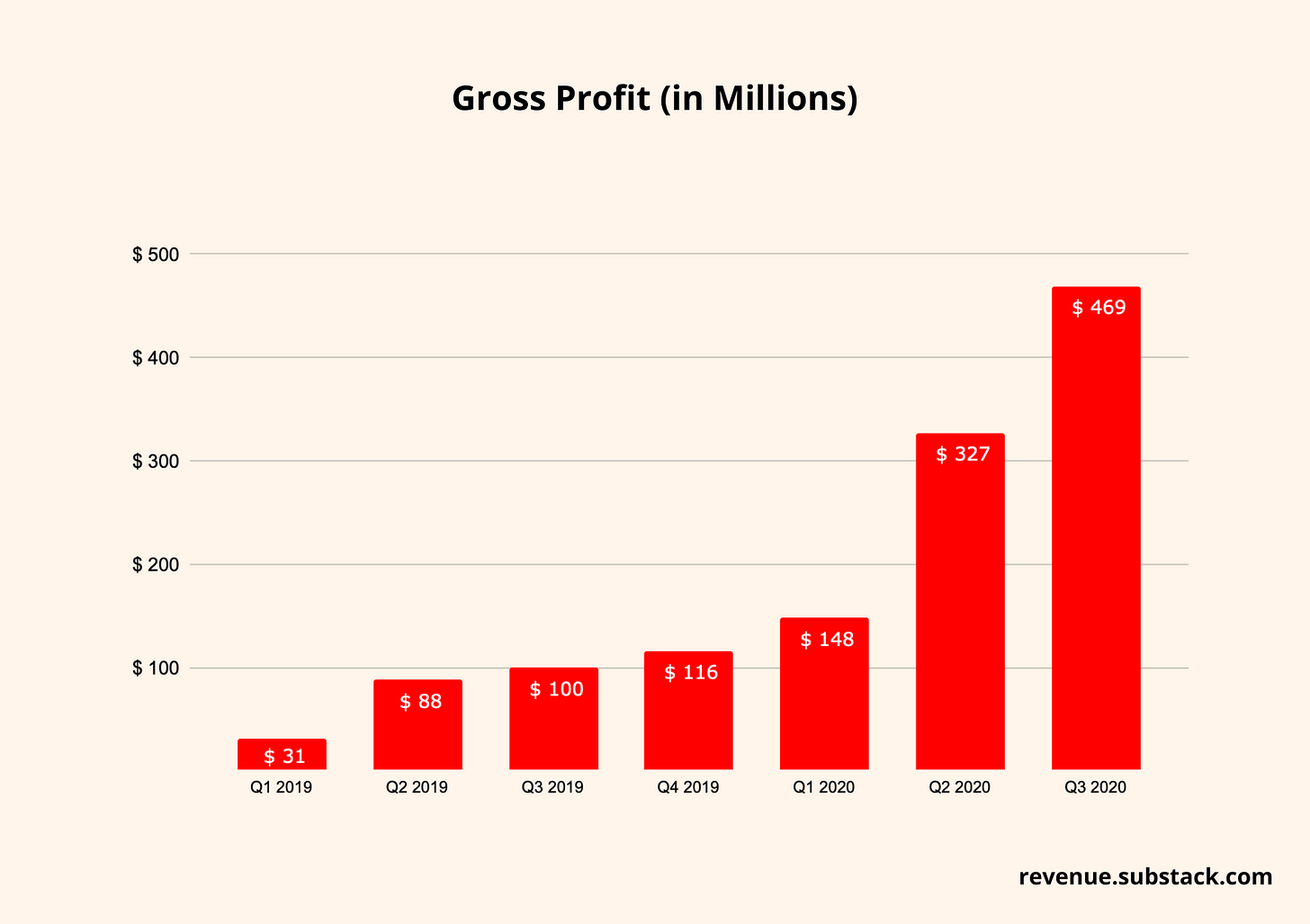

Revenues & Profits

As you will see in the charts below, apart from scaling revenue, DoorDash has been improving its profitability - gross margins and net profits have improved with time.

Future Growth

Apart from growing in the restaurant and food category, DoorDash has multiple levers to scale its revenue:

Improve Dasher Efficiency - By improving the efficiency of dashers, DoorDash can increase its revenue (DoorDash recognizes revenue as the money it earns per order after dasher payout).

Scale DoorDash Drive, and DashPass

There are a lot of businesses that might want to take advantage of DoorDash’s white label logistics service without wanting to be part of its marketplace, and this is where Drive comes into the picture... the opportunity seems massive.

Within 3 years of launch, DashPass has already accumulated 5M customers... leaving a lot of room for future growth. For some context here, Amazon Prime has ~120-130M Prime members in the US.

Expand into new verticals - DoorDash has plans to enter verticals such as pharmacy, groceries and florist - all large markets.

Expand into new countries - DoorDash has already started expanding into new geos by entering Canada and Australia.

This company seems to be amazing at execution - only time will tell how big DoorDash can get :).